{{fund.tabs.5.documents.Legali.Prospetto.0.name}}

{{fund.tabs.5.documents.Legali.Prospetto.0.date}}

Why invest in funds?

Definition of investment funds and how they work

Risk profile

Types of risk

How to handle emotion

The importance of diversification

Fixed Income funds

Convertible bond funds

Strategic funds

Equity funds

SFDR Classification

Other funds

Definition

United Nations Sustainable Development Goals (UN SGDs)

Why incorporate sustainability considerations into the investment process?

Sustainable investment policy of BPS (SUISSE)

Where can I subscribe a Popso (Suisse) fund?

What are the minimum subscription amounts?

What is the difference between a KIID and a factsheet?

How is the fund price (NAV) established?

What is the difference between the management fees and ongoing charges?

If I sell my shares in the fund, how long does it take for the money to reach my account?

Why invest in funds?

Definition of investment funds and how they work

Risk profile

Types of risk

How to handle emotion

The importance of diversification

Fixed Income funds

Convertible bond funds

Strategic funds

Equity funds

SFDR Classification

Other funds

Definition

United Nations Sustainable Development Goals (UN SGDs)

Why incorporate sustainability considerations into the investment process?

Sustainable investment policy of BPS (SUISSE)

Where can I subscribe a Popso (Suisse) fund?

What are the minimum subscription amounts?

What is the difference between a KIID and a factsheet?

How is the fund price (NAV) established?

What is the difference between the management fees and ongoing charges?

If I sell my shares in the fund, how long does it take for the money to reach my account?

There are a number of advantages to investing in investment funds. Investment funds encompass myriad options that can be combined and tailored to the needs of individual investors, enabling multiple objectives to be achieved.

Small and large investors alike can access the significant benefits offered by investment funds:

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

There are a number of advantages to investing in investment funds. Investment funds encompass myriad options that can be combined and tailored to the needs of individual investors, enabling multiple objectives to be achieved. Small and large investors alike can access the significant benefits offered by investment funds:

Read more

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

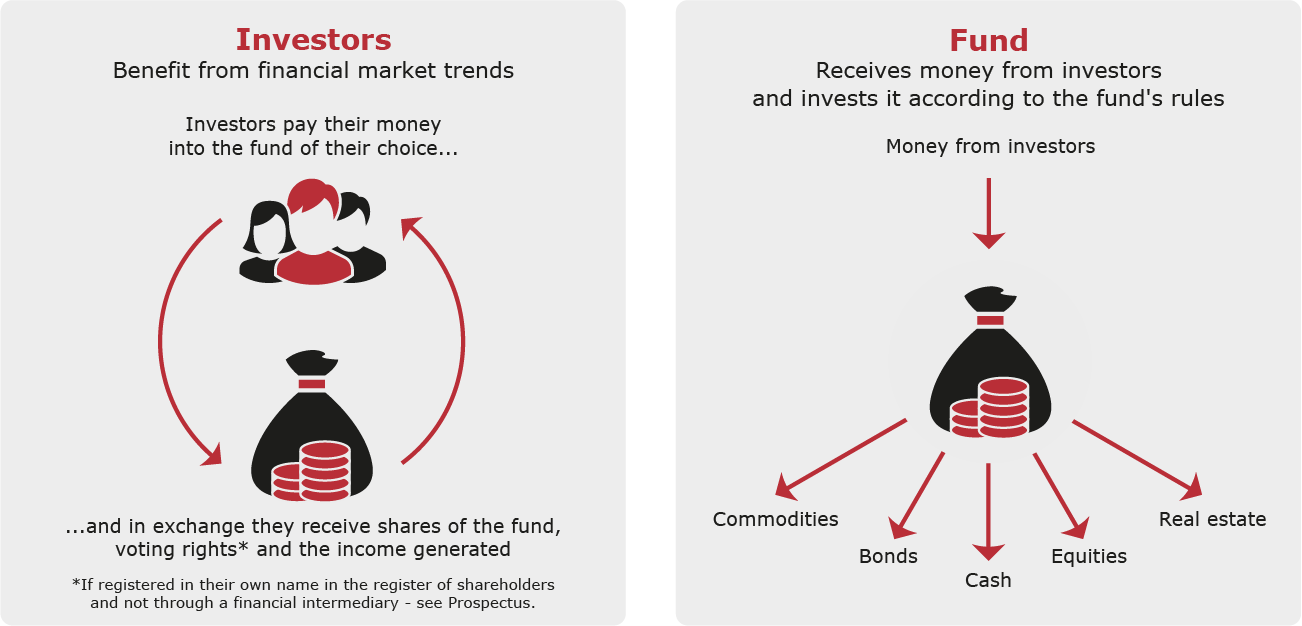

An investment fund is a financial instrument that pools the resources of both small and large investors and manages them as a single pot of assets.

An investment management company is given responsibility for managing this “piggy bank”, thereby enabling large as well as small investors to benefit from professional and diversified management of their investments.

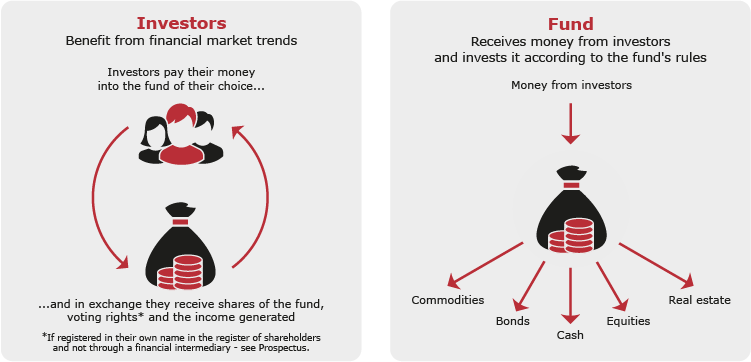

The key issue is to define the investment objective on the basis of offers/proposals, which are generally subdivided into classes. The most common types of assets are cash, bonds, equities, real estate and commodities.

As soon as an investor pays money into a fund, he/she automatically also becomes a shareholder with the right to vote (if registered in its own name in the register of shareholders and not through a financial intermediary - see Prospectus) and receive any income generated by the investment.

SHARE VALUE (NAV)

The price of a share – defined as the NAV (Net Asset Value) – is calculated each business day on the basis of the closing prices from the previous day by dividing the fund's assets, after deducting liabilities and costs, by the total number of shares outstanding.

TRADING

Fund shares can be subscribed to, redeemed or converted each day, according to the procedures described in the Prospectus.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

An investment fund is a financial instrument that pools the resources of both small and large investors and manages them as a single pot of assets. An investment management company is given responsibility for managing this “piggy bank”, thereby enabling large as well as small investors to benefit from professional and diversified management of their investments. The key issue is to define the investment objective on the basis of offers/proposals, which are generally subdivided into classes. The most common types of assets are cash, bonds, equities, real estate and commodities.

As soon as an investor pays money into a fund, he/she automatically also becomes a shareholder with the right to vote (if registered in its own name in the register of shareholders and not through a financial intermediary - see Prospectus) and receive any income generated by the investment.

SHARE VALUE (NAV)

The price of a share – defined as the NAV (Net Asset Value) – is calculated each business day on the basis of the closing prices from the previous day by dividing the fund's assets, after deducting liabilities and costs, by the total number of shares outstanding.

TRADING

Fund shares can be subscribed to, redeemed or converted each day, according to the procedures described in the Prospectus.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

Two rules serve as a guide for any investment:

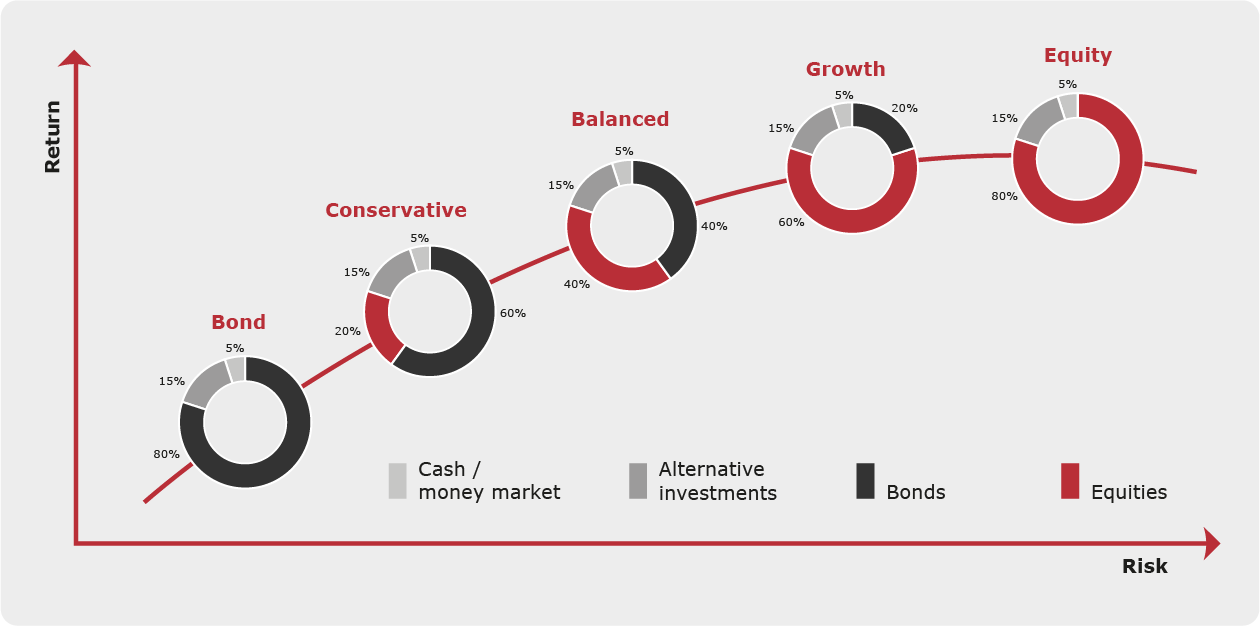

The risk profile is established with reference to appetite for risk based on income and assets, which determines the investor's willingness to take on more or less risk in order to generate the anticipated return.

Establishment of an investment portfolio consistent with the investor's risk profile:

Bond

Conservative

Balanced

Growth

Equity

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

Two rules serve as a guide for any investment: The risk profile is established with reference to appetite for risk based on income and assets, which determines the investor's willingness to take on more or less risk in order to generate the anticipated return. Establishment of an investment portfolio consistent with the investor's risk profile:

Bond

Conservative

Balanced

Growth

Equity

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

When investing money, investors are inevitably exposed to risks; it is therefore important to understand the associated risks and mitigate them as far as possible.

With an active investment fund, risk management is delegated to a team of specialists, which analyses and monitors risks throughout all phases of the investment process.

Thanks to prudent management of the fund by investment professionals, the risk-reward ratio will always be consistent with the strategy pursued.

The main investment risks are described below.

Country risks concern the political and economic stability of a given country. Examples of political risks include the potential confiscation of assets and state intervention in certain industries. Economic risks typically include fluctuations in interest and inflation rates. Other country risks concern the quality of infrastructure and the legislative framework: market transparency, supervisory authorities, investor protection, insolvency regimes and taxation.

Countries with special country risk: emerging markets

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

Most investments involve a risk that the issuer will become insolvent. This is called the issuer risk. A financial instrument’s value depends not only on product-specific aspects – e.g. business results for equities – but also on the issuer’s creditworthiness. This can change at any time during the term of an investment. It is therefore important to know who issued the instrument in question and who is responsible for meeting the obligations. This is essential for correctly assessing the issuer’s creditworthiness and thus the issuer risk. With debt instruments such as bonds, this risk is known as the credit risk because the borrower normally acts as the issuer.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

If a financial instrument is denominated in a currency other than the investor’s reference currency, the risk of exchange rate fluctuations must be taken into account. Some financial service providers recommend using hedging instruments to minimise this risk or offer currency-hedged products. Currency risk can thus be mitigated, but – depending on the asset class and hedging technique in question – it cannot always be completely eliminated.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

Liquidity risk is the risk that an investor will not always be able to sell an investment at an appropriate price. When specific financial instruments or derivatives are difficult or impossible to sell or can only be sold at a greatly reduced price, this is termed an illiquid market. The risk of illiquidity occurs in particular with unlisted and small-capitalisation companies, investments in emerging markets, investments with sales restrictions, some structured products and alternative investments. In addition, liquidity risks cannot be ruled out with bonds if they are merely held after issue and hardly traded at all.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

Changes in a country’s economic activity tend to have an impact on the prices of financial instruments. This is referred to as economic risk.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

Interest rate risk affects investors buying bonds, particularly when interest rates rise as this means that new bonds will be issued with higher rates, making existing bonds with lower rates less attractive and causing their prices to fall.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

Inflation risk is the risk that investors will suffer financial losses as the value of money declines. It is most pronounced for long-term investments in foreign currencies. The central banks of countries with less developed financial markets and low reserves of hard currency are sometimes unable to meet their inflation targets. As a result, inflation and exchange rates in such countries can fluctuate more severely than those in developed countries.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

The prices of financial instruments go up and down over time. Financial experts use the term “volatility” to describe the range of these movements over a specific period. Volatility is a measure of market risk. The higher a financial instrument’s volatility, the more risky an investment it is, as its value could fall sharply.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

Cluster risks are caused by the way an investment portfolio is constructed. They arise when a single financial instrument, a small number of instruments or a single asset class makes up a large share of the portfolio. Portfolios with cluster risks can suffer greater losses than more diversified portfolios in a market downturn. Diversified portfolios spread their investments among different financial instruments and asset classes in order to reduce the overall risk of price fluctuations. When buying and selling financial instruments, it is important to take account of portfolio structure and in particular to ensure sufficient diversification. Cluster risks at issuer, country and sector level must be taken into consideration.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

When investing money, investors are inevitably exposed to risks; it is therefore important to understand the associated risks and mitigate them as far as possible. With an active investment fund, risk management is delegated to a team of specialists, which analyses and monitors risks throughout all phases of the investment process. Thanks to prudent management of the fund by investment professionals, the risk-reward ratio will always be consistent with the strategy pursued. The main investment risks are described below.

Country risks concern the political and economic stability of a given country. Examples of political risks include the potential confiscation of assets and state intervention in certain industries. Economic risks typically include fluctuations in interest and inflation rates. Other country risks concern the quality of infrastructure and the legislative framework: market transparency, supervisory authorities, investor protection, insolvency regimes and taxation.

Countries with special country risk: emerging markets

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

Most investments involve a risk that the issuer will become insolvent. This is called the issuer risk. A financial instrument’s value depends not only on product-specific aspects – e.g. business results for equities – but also on the issuer’s creditworthiness. This can change at any time during the term of an investment. It is therefore important to know who issued the instrument in question and who is responsible for meeting the obligations. This is essential for correctly assessing the issuer’s creditworthiness and thus the issuer risk. With debt instruments such as bonds, this risk is known as the credit risk because the borrower normally acts as the issuer.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

If a financial instrument is denominated in a currency other than the investor’s reference currency, the risk of exchange rate fluctuations must be taken into account. Some financial service providers recommend using hedging instruments to minimise this risk or offer currency-hedged products. Currency risk can thus be mitigated, but – depending on the asset class and hedging technique in question – it cannot always be completely eliminated.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

Liquidity risk is the risk that an investor will not always be able to sell an investment at an appropriate price. When specific financial instruments or derivatives are difficult or impossible to sell or can only be sold at a greatly reduced price, this is termed an illiquid market. The risk of illiquidity occurs in particular with unlisted and small-capitalisation companies, investments in emerging markets, investments with sales restrictions, some structured products and alternative investments. In addition, liquidity risks cannot be ruled out with bonds if they are merely held after issue and hardly traded at all.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

Changes in a country’s economic activity tend to have an impact on the prices of financial instruments. This is referred to as economic risk.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

Interest rate risk affects investors buying bonds, particularly when interest rates rise as this means that new bonds will be issued with higher rates, making existing bonds with lower rates less attractive and causing their prices to fall.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

Inflation risk is the risk that investors will suffer financial losses as the value of money declines. It is most pronounced for long-term investments in foreign currencies. The central banks of countries with less developed financial markets and low reserves of hard currency are sometimes unable to meet their inflation targets. As a result, inflation and exchange rates in such countries can fluctuate more severely than those in developed countries.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

The prices of financial instruments go up and down over time. Financial experts use the term “volatility” to describe the range of these movements over a specific period. Volatility is a measure of market risk. The higher a financial instrument’s volatility, the more risky an investment it is, as its value could fall sharply.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

Cluster risks are caused by the way an investment portfolio is constructed. They arise when a single financial instrument, a small number of instruments or a single asset class makes up a large share of the portfolio. Portfolios with cluster risks can suffer greater losses than more diversified portfolios in a market downturn. Diversified portfolios spread their investments among different financial instruments and asset classes in order to reduce the overall risk of price fluctuations. When buying and selling financial instruments, it is important to take account of portfolio structure and in particular to ensure sufficient diversification. Cluster risks at issuer, country and sector level must be taken into consideration.

Source: SwissBanking, “Risks Involved in Trading Financial Instruments”, edition November 2019

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

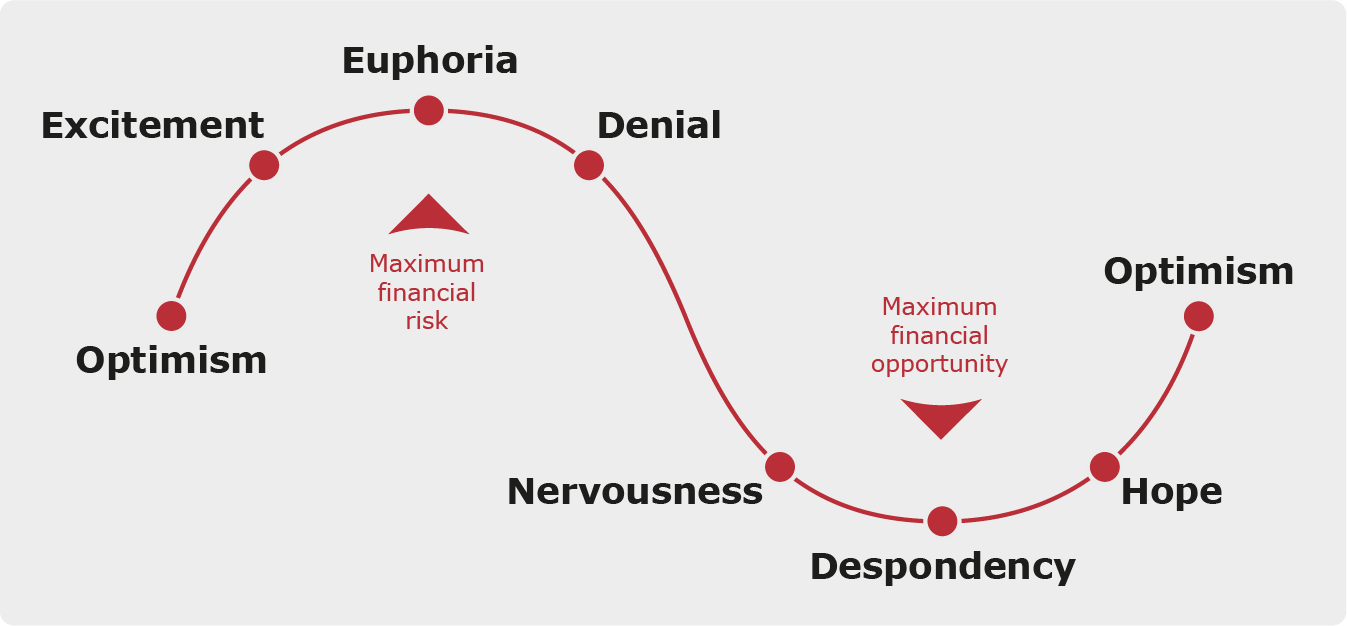

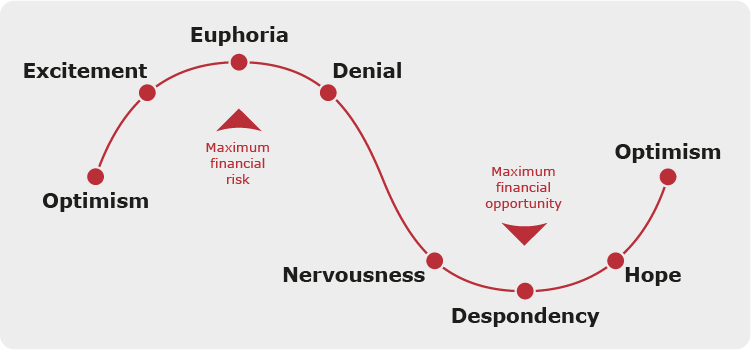

Every decision we take incorporates both rational and emotional elements; sometimes the former prevail, while on other occasions emotions take the upper hand and make us act on impulse.

When we invest our savings, market volatility can influence our state of mind, which is why it is important not to let ourselves get carried away by emotions (whether positive or negative) and to remain focused on the investment objective. It is therefore important not to overlook any risks when investments are performing well, and not to focus on any temporary losses if the markets fall or investments are down. In fact, it is especially important not to lose one's nerve at these times because, historically speaking, the best investment opportunities arise after a market contraction.

How to avoid these extremes?

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

Every decision we take incorporates both rational and emotional elements; sometimes the former prevail, while on other occasions emotions take the upper hand and make us act on impulse.

When we invest our savings, market volatility can influence our state of mind, which is why it is important not to let ourselves get carried away by emotions (whether positive or negative) and to remain focused on the investment objective. It is therefore important not to overlook any risks when investments are performing well, and not to focus on any temporary losses if the markets fall or investments are down.

In fact, it is especially important not to lose one's nerve at these times because, historically speaking, the best investment opportunities arise after a market contraction.

How to avoid these extremes?

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

Spreading your investments over multiple securities will help to reduce risks, as any negative performance of one security may be offset by the positive performance of another. However, the opportunity to increase the number of securities within the portfolio is not sufficient, as it is also necessary to pick them carefully in order to ensure that there is a low correlation between them, i.e. that they react differently to changes in market conditions.

Investment funds are therefore an excellent way of achieving diversification, as they provide access to dozens (in some cases hundreds) of securities, thereby enabling market risks to be lowered significantly, even for small investors.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

Spreading your investments over multiple securities will help to reduce risks, as any negative performance of one security may be offset by the positive performance of another. However, the opportunity to increase the number of securities within the portfolio is not sufficient, as it is also necessary to pick them carefully in order to ensure that there is a low correlation between them, i.e. that they react differently to changes in market conditions. Investment funds are therefore an excellent way of achieving diversification, as they provide access to dozens (in some cases hundreds) of securities, thereby enabling market risks to be lowered significantly, even for small investors.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

Funds

Class

Asset class

Currency

ISIN

Date

NAV

Year to date

Factsheet

KIID

Product sheet

{{this}}

{{/isBestFundColorGold}} {{#isNotBestFundColorGold bestFundPlates funds}}{{this}}

{{/isNotBestFundColorGold}}{{classeSecond}}

{{classe}}

1

{{classeSecond}}

{{currency}}

{{isin}}

{{funds}} - {{classe}} - {{currency}}

Class

{{classeSecond}}

NAV

{{nav}}

Currency

{{currency}}

Date

{{data}}

ISIN

{{isin}}

Year to date

{{ytd}}

Details

{{data}}

{{nav}}

{{ytd}}

The investment offers no guarantee of return to investors, nor does it ensure full or partial repayment of the amount invested.

The investment may be exposed to substantial risks that are not adequately reflected in the synthetic risk indicator and may adversely affect its performance: these include operational, counterparty, liquidity, credit, derivative and sustainability risks.

Any investment decision should only be made on the basis of the most recent version of the prospectus, KIID and available information.

Past performance is not a guarantee of future results.

The investment offers no guarantee of return to investors, nor does it ensure full or partial repayment of the amount invested.

The investment may be exposed to substantial risks that are not adequately reflected in the synthetic risk indicator and may adversely affect its performance: these include operational, counterparty, liquidity, credit, derivative and sustainability risks.

Any investment decision should only be made on the basis of the most recent version of the prospectus, KIID and available information.

Past performance is not a guarantee of future results.

Funds

Class

Asset class

Currency

ISIN

Date

NAV

Year to date

Factsheet

KIID

Product sheet

{{this}}

{{/isBestFundColorGold}} {{#isNotBestFundColorGold bestFundPlates funds}}{{this}}

{{/isNotBestFundColorGold}}{{classeSecond}}

{{classe}}

1

{{classeSecond}}

{{currency}}

{{isin}}

{{funds}} - {{classe}} - {{currency}}

Class

{{classeSecond}}

NAV

{{nav}}

Currency

{{currency}}

Date

{{data}}

ISIN

{{isin}}

Year to date

{{ytd}}

Details

{{data}}

{{nav}}

{{ytd}}

The investment offers no guarantee of return to investors, nor does it ensure full or partial repayment of the amount invested.

The investment may be exposed to substantial risks that are not adequately reflected in the synthetic risk indicator and may adversely affect its performance: these include operational, counterparty, liquidity, credit, derivative and sustainability risks.

Any investment decision should only be made on the basis of the most recent version of the prospectus, KIID and available information.

Past performance is not a guarantee of future results.

The investment offers no guarantee of return to investors, nor does it ensure full or partial repayment of the amount invested.

The investment may be exposed to substantial risks that are not adequately reflected in the synthetic risk indicator and may adversely affect its performance: these include operational, counterparty, liquidity, credit, derivative and sustainability risks.

Any investment decision should only be made on the basis of the most recent version of the prospectus, KIID and available information.

Past performance is not a guarantee of future results.

Funds

Class

Asset class

Currency

ISIN

Date

NAV

Year to date

Factsheet

KIID

Product sheet

{{this}}

{{/isBestFundColorGold}} {{#isNotBestFundColorGold bestFundPlates funds}}{{this}}

{{/isNotBestFundColorGold}}{{classeSecond}}

{{classe}}

1

{{classeSecond}}

{{currency}}

{{isin}}

{{funds}} - {{classe}} - {{currency}}

Class

{{classeSecond}}

NAV

{{nav}}

Currency

{{currency}}

Date

{{data}}

ISIN

{{isin}}

Year to date

{{ytd}}

Details

{{data}}

{{nav}}

{{ytd}}

The investment offers no guarantee of return to investors, nor does it ensure full or partial repayment of the amount invested.

The investment may be exposed to substantial risks that are not adequately reflected in the synthetic risk indicator and may adversely affect its performance: these include operational, counterparty, liquidity, credit, derivative and sustainability risks.

Any investment decision should only be made on the basis of the most recent version of the prospectus, KIID and available information.

Past performance is not a guarantee of future results.

The investment offers no guarantee of return to investors, nor does it ensure full or partial repayment of the amount invested.

The investment may be exposed to substantial risks that are not adequately reflected in the synthetic risk indicator and may adversely affect its performance: these include operational, counterparty, liquidity, credit, derivative and sustainability risks.

Any investment decision should only be made on the basis of the most recent version of the prospectus, KIID and available information.

Past performance is not a guarantee of future results.

Funds

Class

Asset class

Currency

ISIN

Date

NAV

Year to date

Factsheet

KIID

Product sheet

{{this}}

{{/isBestFundColorGold}} {{#isNotBestFundColorGold bestFundPlates funds}}{{this}}

{{/isNotBestFundColorGold}}{{classeSecond}}

{{classe}}

1

{{classeSecond}}

{{currency}}

{{isin}}

{{funds}} - {{classe}} - {{currency}}

Class

{{classeSecond}}

NAV

{{nav}}

Currency

{{currency}}

Date

{{data}}

ISIN

{{isin}}

Year to date

{{ytd}}

Details

{{data}}

{{nav}}

{{ytd}}

The investment offers no guarantee of return to investors, nor does it ensure full or partial repayment of the amount invested.

The investment may be exposed to substantial risks that are not adequately reflected in the synthetic risk indicator and may adversely affect its performance: these include operational, counterparty, liquidity, credit, derivative and sustainability risks.

Any investment decision should only be made on the basis of the most recent version of the prospectus, KIID and available information.

Past performance is not a guarantee of future results.

The investment offers no guarantee of return to investors, nor does it ensure full or partial repayment of the amount invested.

The investment may be exposed to substantial risks that are not adequately reflected in the synthetic risk indicator and may adversely affect its performance: these include operational, counterparty, liquidity, credit, derivative and sustainability risks.

Any investment decision should only be made on the basis of the most recent version of the prospectus, KIID and available information.

Past performance is not a guarantee of future results.

Responsible or sustainable investment is an approach to investing that aims to incorporate ESG (environmental, social and governance) factors into investment decisions, with the aim of better managing risk and generating sustainable, long-term returns (source: PRI 2019).

Since it is an approach that supports the manager when selecting securities, it can be applied to both equities and bonds.

At present, the following funds incorporate a sustainability analysis (ESG) into the investment process:

Funds

Class

Asset class

Currency

ISIN

Date

NAV

Year to date

Factsheet

KIID

Product sheet

{{this}}

{{/isBestFundColorGold}} {{#isNotBestFundColorGold bestFundPlates funds}}{{this}}

{{/isNotBestFundColorGold}}{{classeSecond}}

{{classe}}

1

{{classeSecond}}

{{currency}}

{{isin}}

{{funds}} - {{classe}} - {{currency}}

Class

{{classeSecond}}

NAV

{{nav}}

Currency

{{currency}}

Date

{{data}}

ISIN

{{isin}}

Year to date

{{ytd}}

Details

{{data}}

{{nav}}

{{ytd}}

The investment offers no guarantee of return to investors, nor does it ensure full or partial repayment of the amount invested.

The investment may be exposed to substantial risks that are not adequately reflected in the synthetic risk indicator and may adversely affect its performance: these include operational, counterparty, liquidity, credit, derivative and sustainability risks.

Any investment decision should only be made on the basis of the most recent version of the prospectus, KIID and available information.

Past performance is not a guarantee of future results.

Responsible or sustainable investment is an approach to investing that aims to incorporate ESG (environmental, social and governance) factors into investment decisions, with the aim of better managing risk and generating sustainable, long-term returns (source: PRI 2019). At present, the following funds incorporate a sustainability analysis (ESG) into the investment process:

Since it is an approach that supports the manager when selecting securities, it can be applied to both equities and bonds.

The investment offers no guarantee of return to investors, nor does it ensure full or partial repayment of the amount invested.

The investment may be exposed to substantial risks that are not adequately reflected in the synthetic risk indicator and may adversely affect its performance: these include operational, counterparty, liquidity, credit, derivative and sustainability risks.

Any investment decision should only be made on the basis of the most recent version of the prospectus, KIID and available information.

Past performance is not a guarantee of future results.

In addition to those mentioned, there are also other categories of investment fund, the most common of which are: money market funds, real estate funds, commodity funds, hedge funds, private equity funds, etc.

Popso (Suisse) Investment Fund SICAV does not at present have any funds falling under the categories mentioned above.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

In addition to those mentioned, there are also other categories of investment fund, the most common of which are: money market funds, real estate funds, commodity funds, hedge funds, private equity funds, etc. Popso (Suisse) Investment Fund SICAV does not at present have any funds falling under the categories mentioned above.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

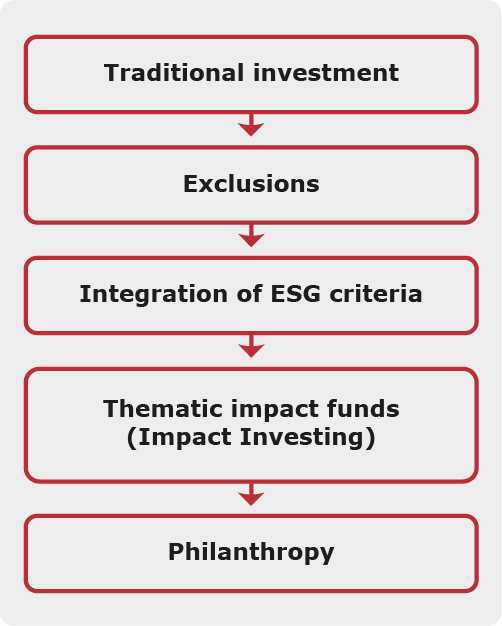

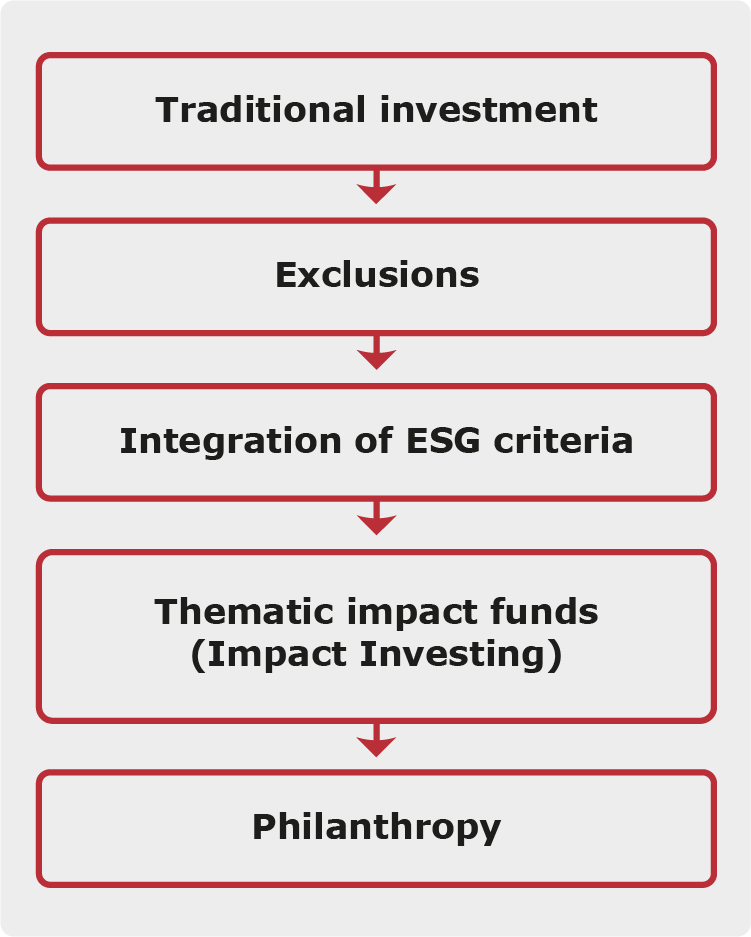

"Sustainable investment is an approach to investing that aims to incorporate ESG factors into investment decisions, with the aim of better managing risk and generating sustainable, long-term returns." (Source: UN PRI 2019)

Approaches to sustainable investment:

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

"Sustainable investment is an approach to investing that aims to incorporate ESG factors into investment decisions, with the aim of better managing risk and generating sustainable, long-term returns." (Source: UN PRI 2019)

Read more

Approaches to sustainable investment:

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

On 25 September 2015, 193 UN member countries approved the 2030 Agenda for Sustainable Development. It has been applicable since 2016, and with its 17 Sustainable Development Goals (SDGs), the Agenda sets out the new global, universal reference framework for sustainable development. UN member countries have pledged to work together to achieve these targets by 2030. The key elements are grouped under the five fundamental principles People, Planet, Prosperity, Peace and Partnerships (known as the 5 Ps.). https://sdgs.un.org/goals

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

On 25 September 2015, 193 UN member countries approved the 2030 Agenda for Sustainable Development. It has been applicable since 2016, and with its 17 Sustainable Development Goals (SDGs), the Agenda sets out the new global, universal reference framework for sustainable development. UN member countries have pledged to work together to achieve these targets by 2030. The key elements are grouped under the five fundamental principles People, Planet, Prosperity, Peace and Partnerships (known as the 5 Ps.). https://sdgs.un.org/goals

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

There are a number of reasons why finance professionals carry out sustainability assessments as part of the investment process:

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

There are a number of reasons why finance professionals carry out sustainability assessments as part of the investment process:

Read more

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

For further information on the sustainable investment policy of the fund's investment manager, BPS (SUISSE), please consult the following link: Sustainable Investment Policy - BPS (SUISSE) (bps-suisse.ch).

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

For further information on the sustainable investment policy of the fund's investment manager, BPS (SUISSE), please consult the following link: Sustainable Investment Policy - BPS (SUISSE) (bps-suisse.ch).

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

Distributor for Switzerland:

Banca Popolare di Sondrio (SUISSE) SA

Via Giacomo Luvini 2a

CH-6901 Lugano

Distributor for Italy:

Banca Popolare di Sondrio S.p.A.

Piazza Garibaldi 16

I-23100 Sondrio

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

Distributor for Switzerland: Distributor for Italy:

Banca Popolare di Sondrio (SUISSE) SA

Via Giacomo Luvini 2a

CH-6901 Lugano

Banca Popolare di Sondrio S.p.A.

Piazza Garibaldi 16

I-23100 Sondrio

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

The minimum subscription amount is 50 CHF / EUR / USD for classes intended for private clients and 5'000 CHF / EUR / USD for classes intended for institutional clients.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

The minimum subscription amount is 50 CHF / EUR / USD for classes intended for private clients and 5'000 CHF / EUR / USD for classes intended for institutional clients.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

The KIID (Key Investor Information Document) is a legal information document, standardised at European level, which provides a summary of key information on the fund and enables clients to make an informed decision before subscribing. To this end, the KIID has five sections:

- Objective and investment policy

- Risk and reward profile

- Charges

- Past performance

- Practical information.

The factsheet, or monthly report is a marketing document, which typically contains information on the fund's composition and performance.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

The KIID (Key Investor Information Document) is a legal information document, standardised at European level, which provides a summary of key information on the fund and enables clients to make an informed decision before subscribing. To this end, the KIID has five sections: - Objective and investment policy

- Risk and reward profile

- Charges

- Past performance

- Practical information.

The factsheet, or monthly report is a marketing document, which typically contains information on the fund's composition and performance.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

The price of a share – defined as the NAV (Net Asset Value) – is calculated each business day on the basis of the closing prices from the previous day by dividing the fund's assets, after deducting liabilities and costs, by the total number of shares outstanding.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

The price of a share – defined as the NAV (Net Asset Value) – is calculated each business day on the basis of the closing prices from the previous day by dividing the fund's assets, after deducting liabilities and costs, by the total number of shares outstanding.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

The ongoing charges are the costs charged, as a percentage, for holding the fund, and include the management, administration and auditing fees, custody fees and a service charge. However, they do not include the entry and exit fees, performance fee or the fund's trading costs, owing to their occasional and non-recurring nature.

The management fee, one of the items comprising the ongoing charges, represents the remuneration due to the investment manager for managing the portfolio.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

The ongoing charges are the costs charged, as a percentage, for holding the fund, and include the management, administration and auditing fees, custody fees and a service charge. However, they do not include the entry and exit fees, performance fee or the fund's trading costs, owing to their occasional and non-recurring nature. The management fee, one of the items comprising the ongoing charges, represents the remuneration due to the investment manager for managing the portfolio.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

All shareholders have the right to redeem their shares in the SICAV at any time and without restriction. The regulations state that share redemption payments will be made within seven business days of the applicable valuation date. Payment is usually made three days after the execution order, if received by the cut-off time.

Please consult the sales prospectus for further information.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

All shareholders have the right to redeem their shares in the SICAV at any time and without restriction. The regulations state that share redemption payments will be made within seven business days of the applicable valuation date. Payment is usually made three days after the execution order, if received by the cut-off time. Please consult the sales prospectus for further information.

A valuation by a professional manager does not mean that the investment is risk-free. The investment does not offer any kind of capital guarantee and the investor may lose some or all of the amounts committed.

In accessing the website of Popso (Suisse) Investment Fund SICAV and its various pages, the user hereby declares that he/she has understood and accepts the legal information relating to this website. Access to the information contained in this website may be restricted by laws or regulations applicable to the user. The persons to whom these prohibitions apply may not access this website or any page contained in it.

The fund range of Popso (Suisse) Investment Fund SICAV, domiciled in Luxembourg, is registered in principle for sale to the public in Luxembourg, Switzerland and Italy. However, due to different national registration procedures, it is not possible to guarantee that every fund, sub-fund or type of share can be registered at the same time, or will be registered, in each of the countries mentioned. An up-to-date list may be obtained on www.popsofunds.com. In the countries in which a fund, a sub-fund or a type of share is not registered for public sale and placement, units may only be sold in compliance with current applicable national legislation.

Any decision to invest in the sub-funds described on this website should only be taken after a careful examination of the applicable Prospectus, the last certified Annual Report, the most recent Semi-annual Report and the legal information provided on the website. The Prospectus may be obtained free of charge by downloading it from this website or by requesting a copy from the parties responsible for placement.

No offer

The information and opinions published on this website do not constitute an invitation, an offer or a recommendation to purchase or sell investments of any kind or to conclude any other transaction. The investments mentioned on the website are not directed at persons resident in any country, state or jurisdiction where such an offer would not be compliant with local laws or regulations.

No warranty

Although Popso (Suisse) Investment Fund SICAV makes every effort to obtain information from reliable sources, it cannot warrant the accuracy, reliability or completeness of the information and opinions contained in the website. Accordingly, Popso (Suisse) Investment Fund SICAV does not accept any liability as regards the up-to-date status, accuracy and completeness of the contents of the website. The information and opinions contained in the website are intended exclusively for private use and for information purposes. Said information and opinions may be modified at any time without notice. Popso (Suisse) Investment Fund SICAV does not use the website for the purpose of offering investment or other advice. The information contained in the website does not constitute a reliable basis for decisions concerning investments or of any other type.

Disclaimer

Popso (Suisse) Investment Fund SICAV declines all liability, including in the event of minor negligence, for any direct or indirect losses of any type resulting from any errors/omissions or inaccuracies affecting the information published or otherwise relating to access to, usage of, the performance of, browsing on or links to this website or to other websites. Popso (Suisse) Investment Fund SICAV does not warrant the uninterrupted operation of its website, and provides no assurance that it will be free from viruses or other potentially harmful components. Therefore, it shall not incur any liability for any malfunctions, faults or technical problems relating to the website and/or the web.

Risks

Positive performance in the past does not imply any guarantee in relation to present or future returns. Every investment is subject to market fluctuations. Therefore, the maintenance or growth of the capital invested cannot be guaranteed and it is possible that, when redeeming shares, an investor may receive an amount lower than that originally invested. In addition, fluctuations in exchange rates for foreign currencies may entail a reduction or increase in the value of investments.

Risks associated with investment

Each sub-fund is associated with specific risks, such as for example the risk resulting from recourse to derivative financial instruments and the risks associated with investing in emerging markets. It is recommended that you consult the relevant section of the Prospectus for further information concerning risks, and that you also contact your financial advisers.

Copyright

The contents and structure of the pages on the website of Popso (Suisse) Investment Fund SICAV are protected by copyright. All rights are reserved. The contents of the website may be accessed free of charge for the sole purpose of consultation. It is not permitted to reproduce (either in full or in part), to transmit (either electronically or in any other manner) or to modify any material, to create any links or to use the website for public or commercial purposes without the written approval of Popso (Suisse) Investment Fund SICAV.

Cookies

Cookies are small text strings stored on users' computers in order to track the web pages they visit and their preferences when browsing and are sometimes used to save settings between sessions. Cookies allow developers of electronic services to collect statistical data on the frequency of visits to certain areas of a website to help them design websites that are more useful and more accessible. The Popso (Suisse) Investment Fund SICAV website only uses technical cookies, which are cookies that are used to enable you to navigate and use the website.

{{fund.title}} {{#isLastBestFundPlates fund.bestFundPlates}} {{/isLastBestFundPlates }}

{{fund.type}}

{{fund.isin}}

{{fund.clas}}

{{label}}

{{value}}

The value and income of investments held may fluctuate according to market conditions and exchange rates; the investor may lose some or all of the amounts invested.

*The risk category is based on historical data and may not be a reliable indication of the future risk profile of the investment. It may change over time. Being in a lower category does not mean that the investment is risk-free. The investment does not offer any kind of guarantee of the capital that may be lost in whole or in part.

The investment may be exposed to substantial risks that are not adequately reflected in the synthetic risk indicator and may adversely affect performance. These include operational or counterparty, liquidity, credit, derivatives and sustainability risks. An in-depth description can be found in the full prospectus and KIID.

Source: Carne Global Fund Managers (Luxembourg) S.A.

{{text}}

{{label}}

{{value}}

{{label}}

{{value}}

{{label}}

{{value}}

The Distributor may charge additional fees (e.g. entry or exit fees). Please refer to your financial advisor for more information.

The maximum issue and redemption fees contained in the prospectus may not be exceeded.

Source: Carne Global Fund Managers (Luxembourg) S.A.

{{{fund.tabs.2.cards.3.text}}}

{{label}}

{{value}}

The actual taxation depends on the competent local authorities, so please consider your specific situation.

Past performance is no guarantee or indication of future results.

{{label}}

{{value}}

Past performance is no guarantee or indication of future results.

The performance figures do not take into account any fees or charges that may be applicable and are debited at the time of issue and redemption of the units.

If the sub-fund is denominated in a currency other than an investor's reference currency, changes in the exchange rate may have an adverse impact on price and income.

The value of the money invested in the fund may rise or fall. The investor may lose some or all of the money invested.

{{label}}

{{value}}

Past performance is no guarantee or indication of future results.

The performance figures do not take into account any fees or charges that may be applicable and are debited at the time of issue and redemption of the units.

If the sub-fund is denominated in a currency other than an investor's reference currency, changes in the exchange rate may have an adverse impact on price and income.

The value of the money invested in the fund may rise or fall. The investor may lose some or all of the money invested.

{{label}}

{{value}}

{{{fund.tabs.3.cards.4.elements.1.value}}}

{{/exists}}{{{fund.tabs.3.cards.4.elements.0.value}}}

{{label}}

{{value}}

{{label}}

{{value}}

{{label}}

{{label}}

{{label}}

{{label}}

{{label}}

{{label}}

{{label}}

{{label}}

{{label}}

{{value}}

{{label}}

{{value}}

All rights reserved.

The information contained herein is the property of Popso (Suisse) Investment Fund SICAV and/or its content providers, may not be copied or distributed, and is not guaranteed to be accurate, complete or timely.

Popso (Suisse) Investment Fund SICAV and its content providers shall not be liable in any way for any damages or losses arising from any use of this information.

The actual taxation depends on the competent local authorities, so please consider your specific situation.

Source: Carne Global Fund Managers (Luxembourg) S.A.

{{fund.tabs.5.documents.Legali.Prospetto.0.name}}

{{fund.tabs.5.documents.Legali.Prospetto.0.date}}

{{fund.tabs.5.documents.Legali.Rapporto_annuale.0.name}}

{{fund.tabs.5.documents.Legali.Rapporto_annuale.0.date}}

{{fund.tabs.5.documents.Legali.Rapporto_semestrale.0.name}}

{{fund.tabs.5.documents.Legali.Rapporto_semestrale.0.date}}

{{fund.tabs.5.documents.Marketing.Avviso-agli-azionisti.0.name}}

{{fund.tabs.5.documents.Marketing.Avviso-agli-azionisti.0.date}}

{{fund.tabs.5.documents.Marketing.Factsheet.0.name}}

{{fund.title}} {{#isLastBestFundPlates fund.bestFundPlates}} {{/isLastBestFundPlates }}

{{fund.type}}

{{fund.isin}}

{{fund.clas}}

{{#oneFundPlates fund.bestFundPlates}}

{{label}}

{{value}}

The value and income of investments held may fluctuate according to market conditions and exchange rates; the investor may lose some or all of the amounts invested.

*The risk category is based on historical data and may not be a reliable indication of the future risk profile of the investment. It may change over time. Being in a lower category does not mean that the investment is risk-free. The investment does not offer any kind of guarantee of the capital that may be lost in whole or in part.

The investment may be exposed to substantial risks that are not adequately reflected in the synthetic risk indicator and may adversely affect performance. These include operational or counterparty, liquidity, credit, derivatives and sustainability risks. An in-depth description can be found in the full prospectus and KIID.

Source: Carne Global Fund Managers (Luxembourg) S.A.

{{fund.tabs.1.cards.0.text}}

{{fund.tabs.1.cards.1.text}}

{{fund.tabs.1.cards.2.text}}

{{label}}

{{value}}

{{label}}

{{value}}

{{label}}

{{value}}

{{{fund.tabs.2.cards.3.text}}}

{{label}}

{{value}}

The Distributor may charge additional fees (e.g. entry or exit fees). Please refer to your financial advisor for more information.

The maximum issue and redemption fees contained in the prospectus may not be exceeded.

Source: Carne Global Fund Managers (Luxembourg) S.A.

The actual taxation depends on the competent local authorities, so please consider your specific situation.

{{label}}

{{value}}

{{label}}

{{value}}

{{label}}

{{value}}

{{{fund.tabs.3.cards.4.elements.1.value}}}

{{/exists}}{{{fund.tabs.3.cards.4.elements.0.value}}}

Past performance is no guarantee or indication of future results.

Past performance is no guarantee or indication of future results.

The performance figures do not take into account any fees or charges that may be applicable and are debited at the time of issue and redemption of the units.

If the sub-fund is denominated in a currency other than an investor's reference currency, changes in the exchange rate may have an adverse impact on price and income.

The value of the money invested in the fund may rise or fall. The investor may lose some or all of the money invested.

{{label}}

{{value}}

{{label}}

{{label}}

{{label}}

{{label}}

{{label}}

{{label}}

{{label}}

{{label}}

{{label}}

{{label}}

{{value}}

All rights reserved.

The information contained herein is the property of Popso (Suisse) Investment Fund SICAV and/or its content providers, may not be copied or distributed, and is not guaranteed to be accurate, complete or timely.

Popso (Suisse) Investment Fund SICAV and its content providers shall not be liable in any way for any damages or losses arising from any use of this information.

The actual taxation depends on the competent local authorities, so please consider your specific situation.

Source: Carne Global Fund Managers (Luxembourg) S.A.